First European Climate Risk Assessment Report (EUCRA): An Alarm Signal for Immediate Action

The European Environment Agency (EEA) is a European Union agency founded in 1990 by the EU’s partner countries, which make up the EEA, along with Norway, Iceland, Liechtenstein, Turkey and Switzerland.

Its mission is to provide reliable and independent information on the environment to citizens, political and economic decision-makers, in particular the European institutions (European Commission, European Parliament, Council of the European Union, etc.). One of the EEA’s objectives is to support sustainable development by helping to make significant and measurable improvements to Europe’s environment and by developing the network of national environmental protection bodies.

This is the aim of the European Climate Risk Assessment (EUCRA) 1st report produced by the EEA.

Introduction: Europe on the threshold of a climate crisis

The record-breaking year of 2023 marks a historic turning point, becoming the hottest year on record. This alarming fact propels Europe, and the whole world, into an era of unprecedented climatic consequences. In response to this urgency, the European Environment Agency (EEA), at the request of the European Commission, has published the first European Climate Risk Assessment (EUCRA) report.

Drawing on state-of-the-art data from authorities such as the Intergovernmental Panel on Climate Change (IPCC), the Copernicus Climate Change Service (C3S), and the European Commission’s Joint Research Centre (JRC), the report highlights an alarming escalation in warming in Europe. Average temperatures are now well above pre-industrial levels, signaling a growing climate emergency.

This document offers a precise diagnosis of the climate risks and outlines immediate ways of adapting to them.

Europe in the midst of global warming: the reality in figures

The IPCC’s sixth report highlights the growing risks associated with heat and drought in Europe, predicting a significant rise in temperatures and extreme weather events. These changes could lead to major challenges in terms of public health, water shortages and agricultural losses, especially with warming exceeding 3°C. In addition, adaptation to the new climatic conditions could prove difficult, particularly in the southern and eastern regions of Europe.

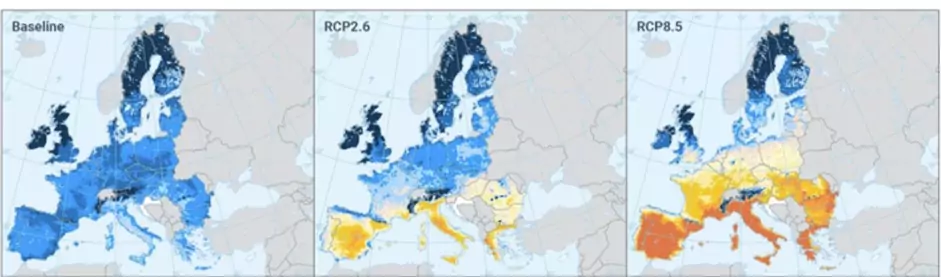

The graphs below visualize these issues, showing projected heat exposure and vulnerability across the continent.

The following three maps illustrate the average number of heatwave days (HWDs) for two periods and scenarios:

- The map on the left shows the base period from 1986 to 2005,

- The central map projects future conditions for 2041-2060 under the Representative Concentration Path (RCP) 2.6 scenario,

The map on the right shows the RCP 8.5 scenario.

The colour scale for these maps varies from blue (0 HWDs) to red (>40 HWDs), indicating the frequency of heatwave days.

The three maps below show the vulnerability index in Europe:

- The map on the left shows the basic socio-economic conditions in 2015,

- The map in the centre shows projections under shared socio-economic path (SSP) 1, indicating low vulnerability,

- The map on the right shows the projections under SSP 3, indicating high vulnerability.

The vulnerability index takes into account factors such as income, education, ageing, artificial surfaces, social isolation and pre-existing medical conditions. The vulnerability scale is presented in deciles, with dark red indicating the highest decile of vulnerability.

Source: Adapted from (Rohat et al., 2019a) (Fig. 1 and 3).

Comparing the baseline map of HWDs with the two future RCP scenarios, there is a clear increase in the frequency of heatwave days across Europe, particularly under the RCP 8.5 scenario.

The vulnerability maps indicate that future scenarios could lead to an increase in vulnerability in many parts of Europe, especially under scenario SSP 3. This suggests that unfavourable socio-economic factors, combined with an increase in heat waves, could increase public health risks and necessitate increased adaptation and prevention measures.

Since the 1980s, Europe has been warming at almost twice the rate of the global average. Between February 2023 and January 2024, the rise in the global average temperature exceeded the critical threshold of 1.5°C above pre-industrial levels. The increased frequency of heatwaves, now less exceptional, culminated in the summer of 2022, with an estimated 60,000 to 70,000 premature deaths in Europe directly linked to extreme heat.

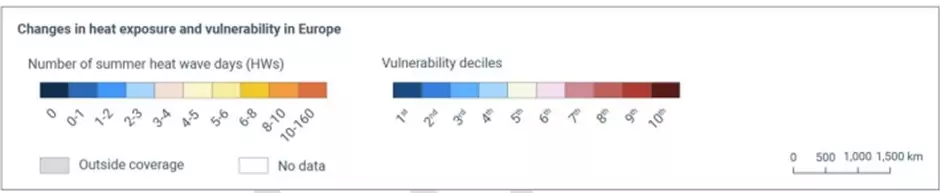

The graph below shows an analysis of the warming trend in Europe. Observed and projected data show a continuous long-term increase in annual and seasonal temperatures. This increase has been more marked over the last 30 years than over the previous 70.

Source: Copernicus Climate Change Service, C3S.

The graph combines historical observations with projections based on different socio-economic scenarios. Modelled past temperatures and observations are shown in blue, while future projections based on four trajectories are represented by different colours, ranging from yellow to dark red, corresponding to greenhouse gas emission levels ranging from low to very high.

A clear upward trend in temperature from 1950 to the present in terms of historical observations. All the scenarios show a continuing rise in temperatures, with significant differences between the low-emissions (SSP1-2.6) and high-emissions (SSP3-7.0 and SSP5-8.5) trajectories, suggesting a much greater warming potential in the high-emissions scenarios.

The model also illustrates the increasing spread of uncertainty ranges in future projections, signaling an increase in uncertainty linked to the response of the climate system to different levels of greenhouse gas emissions.

In addition, EUCRA also demonstrates the intensification of precipitation and extreme weather events that underline the reality of the upheaval underway, with devastating floods hitting various regions, such as Germany and Belgium in 2021 (causing €44 billion in damage and over 200 deaths), Slovenia in 2023 (with damage equivalent to around 16% of its national GDP), and Greece in 2023, submerging key agricultural production areas.

Against this backdrop of major climatic disruption, the financial and insurance sectors face the immense challenge of measuring, mitigating and managing the economic consequences of this crisis.

The economic cost of climate change: a major challenge

The economic impacts of climate change are wide-ranging, affecting every sector of society in profound and unavoidable ways. According to EEA analyses, the interaction between climatic hazards, such as heat waves, prolonged droughts and floods, and non-climatic risk factors, including ecosystem fragmentation, pollution, and unsustainable agricultural and water management practices, threatens Europe’s food security, public health, ecosystems, infrastructures and economy.

These climate impacts can lead to cascades of risks, systematically affecting all societies and imposing a disproportionate burden on vulnerable social groups. If these climate risks are not kept under control, the economic cost, particularly of coastal flooding, could exceed the threshold of one trillion euros per year by the end of the century.

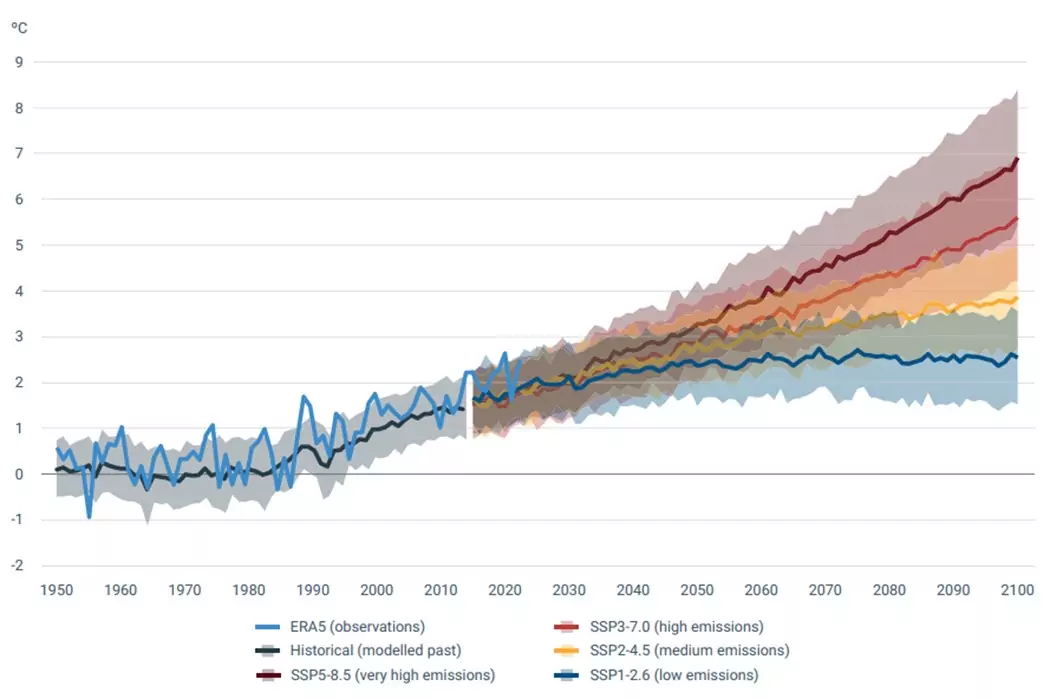

The analysis by “Forzieri et al. 2018” of the current risks to European infrastructure presented in the graph below, estimates the future financial risks for different infrastructure systems up to 2080. They estimate that while annual economic damage to European infrastructure in the 2000s amounted to EUR 3.4 billion, it could rise to EUR 9.3 billion in the 2020s, EUR 19.6 billion in the 2050s, and EUR 37.0 billion in the 2080s.

Source: Adapted from Forzieri et al., 2018.

The length of the bars indicates the median of the ensemble, also reporteds e in numerical labels in millions. The whiskers reflect the climatic variability between the different models. The colours indicate the relative change in damage compared with the reference period.

The energy sector is expected to see the biggest increase in damage, followed by the transport sector, industry and the social sector. Currently, river flooding and windstorms account for the majority of multi-sector damage. However, by the end of the century, damage due to drought and heat waves could account for almost 90% of damage linked to climatic hazards, according to the analysis.

It should be noted that the values quoted above represent average estimates of annual damage and do not necessarily reflect the peaks in damage that may occur in specific years or climatic events, which are often much higher than these averages. In addition, it is important to stress that these forecasting models could underestimate the real impact of climate change. Recent studies, which indicate an increase in intense precipitation and storm flooding, have not been fully integrated into these analyses. These events, if taken into account, could reveal even more significant economic damage than is currently projected.

Source : EEA

This underscores the urgent need for massive investment in resilient infrastructure, technological innovation and community preparedness to meet the financial challenges ahead. Nevertheless, the mobilisation of the necessary funds is hampered by uncertainty about the future evolution of climate impacts, requiring a concerted strategy between governments, financial institutions and international organisations to devise creative and effective financing mechanisms. These solutions must not only support the transition to a climate-resilient future, but also incorporate an understanding of the cascades of risks to prevent the deterioration of the foundations of basic human needs.

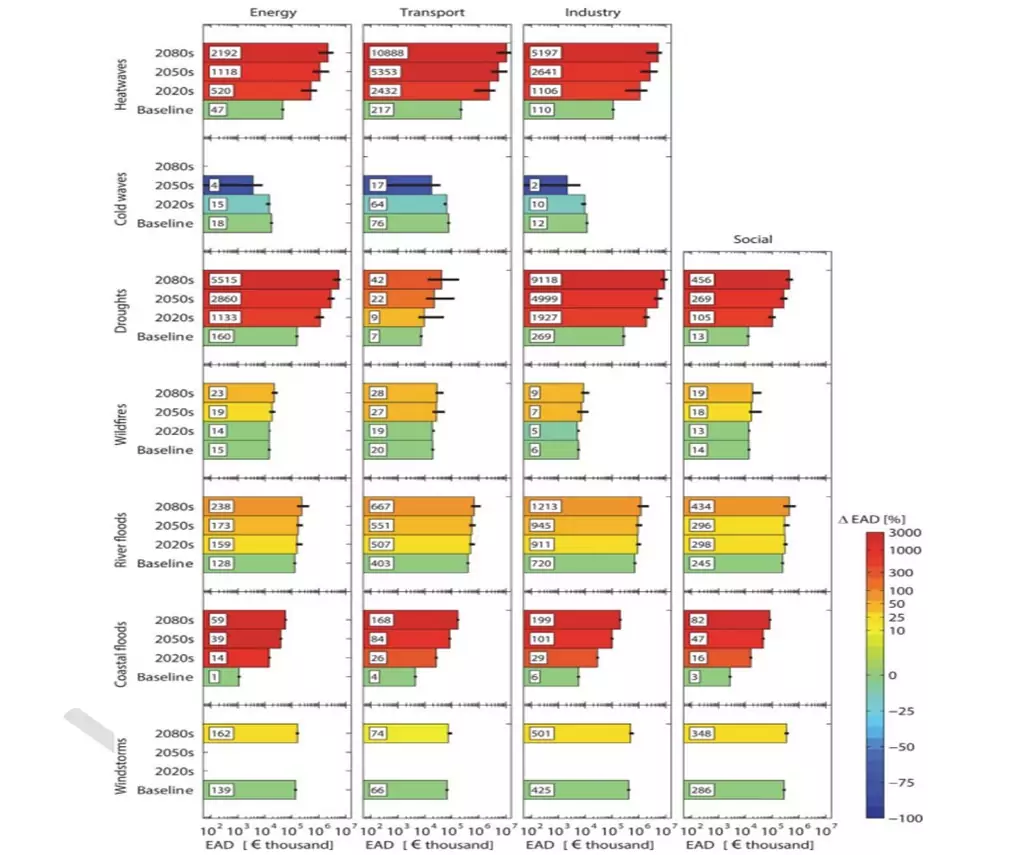

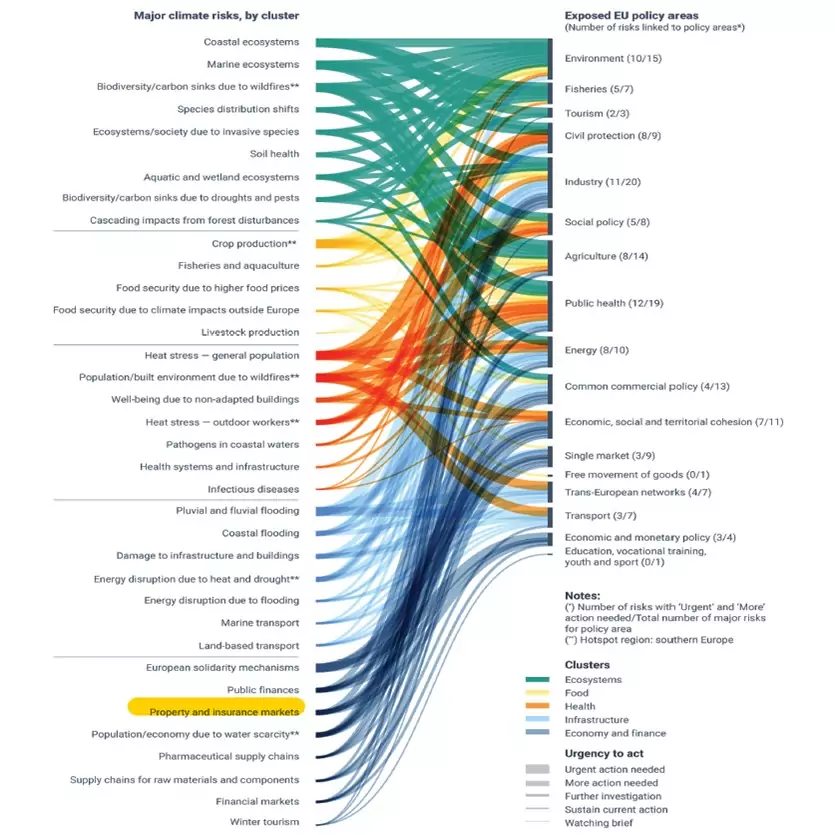

In this search for concerted and innovative approaches to financing climate resilience and preventing the harmful impacts of climate change, the strategic importance of the insurance market is emerging as a key element. The following figure, from the European Environment Agency, eloquently depicts the complex interactions between major climate risks in Europe and vulnerable policy sectors.

At the heart of these interactions, the insurance sector stands out as an essential pivot, underlining its indispensable role in linking and supporting virtually all areas affected by climate change. By providing cover against risks in a wide range of sectors – from energy to agriculture to public health – insurance makes a significant contribution to financial stabilization in the event of climate disruption and to reducing its impact on the global economy and social cohesion.

In conclusion, insurance has a role to play in contributing to resilience in the face of immediate challenges, but also in promoting a sustainable transition and supporting long-term adaptation efforts in the face of a changing climate.

The pivotal role of the insurance sector in mitigating climate risks

The role of the insurance sector in managing the economic challenges posed by accelerating climate change is undeniable. As a key player in risk management, the insurance industry plays a crucial role in encouraging preparedness and facilitating adaptation to extreme weather events. It is essential in mitigating the financial repercussions of natural disasters for individuals and businesses, thereby facilitating post-disaster recovery and reconstruction. With extreme weather events on the increase and intensifying, the industry is facing unprecedented challenges.

In France, insurers are doing their utmost to navigate through the complexities of climate change while avoiding the risk of uninsurability seen in other regions, such as the United States. The increase in the frequency and severity of natural disasters is certainly driving up claims and, potentially, insurance premiums. However, insurers are actively engaged in finding solutions to maintain the accessibility of insurance while covering risks in a fair and sustainable way.

Far from reducing cover in high-risk areas, French insurers rely on schemes such as the NAT CAT (Natural Catastrophes) system to offer comprehensive protection against extreme natural events. This compulsory public risk transfer scheme represents a model of adaptation and collaboration between the public sector and private insurers, ensuring effective and accessible cover for the home against climatic hazards.

In addition, when it comes to climate-related property risks, insurers are incorporating these considerations into their investment and hedging strategies. Instead of passively absorbing the impact of climate change on property values, insurers are working with banks and the public sector to develop resilient models that minimise economic and financial disruption. For example, in collaboration with local authorities and developers, insurance companies such as AXA in France have implemented programmes to increase the resistance of buildings to flooding. One of the pilot projects involves the installation of removable flood barrier systems for properties located in flood-prone areas. As well as protecting property, these preventative measures reduce the cost of future claims, which can help to contain increases in insurance premiums for all residents in the area.

In addition, AXA has also launched a €350 million fund in 2020 to invest in startups developing technologies to combat climate change, including those focused on improving the sustainability of urban infrastructure.

Swiss Re, another insurance giant, has launched a number of initiatives aimed at reducing the vulnerability of properties to flooding. Working with local governments in Europe, Swiss Re has developed flood risk maps that help proactively plan flood prevention and mitigation measures, such as the construction of retaining walls and natural overflow areas. These efforts not only help to reduce insurance premiums for less exposed properties, but also guide land-use planning policies.

Allianz SE also works with banks to finance sustainable infrastructure projects. They have invested in wind and solar farm projects across Europe, recognizing that supporting the energy transition reduces the long-term risks associated with climate change. These projects contribute to a reduction in carbon emissions while generating stable returns for stakeholders.

A notable example of collaboration between insurers, banks and the public sector is the Climate Resilience and Adaptation Finance and Technology Transfer Facility (CRAFT) project, which aims to mobilize private capital to finance climate-resilient infrastructure. This project involves partners such as the World Bank, insurance companies and private financial institutions, and focuses on financing projects that increase the climate resilience of vulnerable communities.

These examples show how insurance companies not only respond to claims, but also play a proactive role in preventing risks and helping society to become more resilient in the face of climate change.

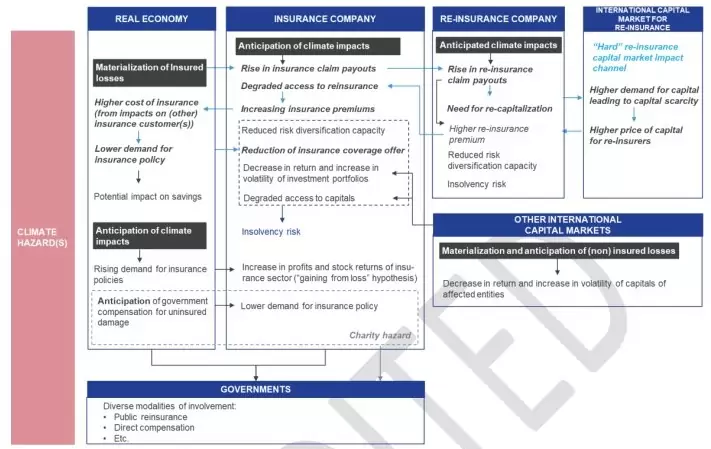

The visualization below provides a basis for reflection on the interdependence between climate risks and financial stability, highlighting the economic reality of discounting insured losses and the anticipated impact of climate change on insurance demand and supply, describes the mechanisms by which insurance companies adapt their premiums, cover and investment strategies to absorb and spread these risks, and highlights the interaction with the reinsurance market, exposing the challenges of recapitalisation and the pressure on reinsurance premiums. The chart also extends into the realm of international capital markets, revealing the impact of these dynamics on the cost and availability of capital, and the role involving government in this scheme.

In the light of the evidence presented, the importance of close collaboration between insurance companies, public authorities and international organisations is highlighted in order to develop innovative insurance solutions that are accessible to a wide audience. By increasing the scope of insurance coverage and incorporating risk reduction incentives, the sector can play a decisive role not only in mitigating the economic impacts of climate change, but also in promoting adaptation and building resilience.

Current assessments indicate that the European macro-fiscal and financial system is under considerable threat from the impacts of climate change, both inside and outside Europe, which could catalyse a systemic financial shock. Existing stress tests provide an initial assessment of the risks for major financial players, but tend to underestimate the cascading and cumulative risks and the extreme risks associated with rare events. This finding calls for a strengthening of financial stress tests to better account for these risks, including broader sets of hazards and scenarios. This improvement is essential to anticipate potential systemic financial shocks and to design insurance policies that strengthen resilience while offering affordable access, particularly in the face of extreme climatic events. Such policies should promote insurance that incorporates provisions that enhance resilience, while incentivising the reduction of vulnerabilities, and taking into account the wide disparities in insurance penetration between Member States.

By adapting its strategies and cooperating closely with the public and private sectors, the insurance industry is becoming an essential pillar in reducing economic risks and speeding up efforts to adapt to climate change.

Risk score projection: an essential tool for resilience

In an era of rapid and unpredictable climate change, the ability to accurately assess and project risk scores is essential for decision-makers, businesses and communities. These assessments, measuring the probability and potential consequences of climate events, play a decisive role in the development of effective adaptation and mitigation strategies. They ensure that investments are targeted at the areas most at risk and vulnerable.

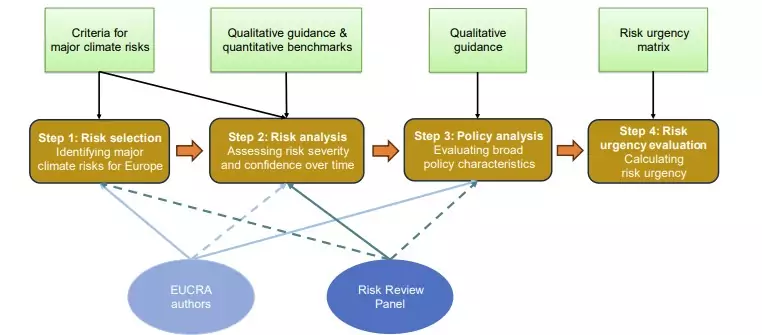

The analysis presented in the EEA’s executive summary stresses the urgency of responding proactively to the climate risks identified, highlighting the compelling need for rigorous risk assessment, supported by in-depth qualitative analysis. The accurate projection of these risk scores is crucial to effectively prioritize initiatives and optimize the distribution of resources. This approach enables an agile response to current challenges while preparing the ground for future threats, by constantly adapting policies and practices to an ever-changing environment.

Structured risk assessment in EUCRA

However, achieving absolute accuracy in these projections remains a major challenge, due to the complexity of the interactions between climate and socio-economic systems. It is essential that the models used are continually refined and updated with the latest climate observations and data, in order to maintain their acuity and applicability.

In short, the incorporation of scalable risk scores, supported by robust evidence, into climate-related planning and decision-making processes marks a fundamental step towards a sustainably resilient society. This strategic approach equips us to move forward with greater confidence in the face of an uncertain climate future, minimizing negative impacts while amplifying opportunities for successful and beneficial adaptation.

Addactis’ point of view:

Historically, reinsurers have modelled climatic risks on a geographical scale ranging, depending on the player, from the commune to the department. At Addactis, we are convinced that it is necessary to take into account the specific physical characteristics of buildings exposed to different climatic perils, in addition to meteorological aspects. To this end, Addactis has been working for several years on assessing the climatic risk levels of each building in France, resulting in the creation of scores that are completely new on the market and accessible via its Insurance Smart Home Pricing® solution.

These scores, which are available for drought, flood and now storm risks, are unique in that, in addition to climate data, they include data on the structure and environment of buildings. As part of this risk-based approach, this provides an unprecedented view of the vulnerability of each building in terms of its exposure to different climatic perils.

For the future, Addactis wants to go even further by projecting these scores to take account of climate change and therefore the change in exposure that the French territory could undergo. This involves projecting meteorological data according to different climate change scenarios (logically based on the work of the IPCC) in order to then determine the change in exposure that each building could undergo in the face of each climatic hazard.

In particular, this work will make it possible to determine whether a property that is vulnerable to a climate risk but currently has low exposure to it could, by 2050, become particularly risky as a result of higher exposure to this risk (assuming that its level of vulnerability would remain unchanged by then).

Policy and regulatory strategies for an effective response to climate challenges

In the face of escalating climate risks and their economic repercussions, the development of robust and forward-looking policy and regulatory frameworks is imperative. These structures play a decisive role in promoting adaptation and climate resilience, particularly in the financial and insurance sectors. They create an environment conducive to the efficiency of these sectors, stimulating investment in resilient infrastructures and the development of innovative insurance products.

Although significant progress has been made in understanding and preparing for climate risks, the EEA report highlights a significant delay in the application of policies in the face of rapidly increasing risks. This underlines the urgency of mobilizing concerted and reinforced action at every level of governance to increase Europe’s climate resilience.

The European Union and its Member States are fine-tuning their responses to climate challenges through national risk assessments, which then guide the development of adaptation strategies. However, despite these efforts, society is still not sufficiently prepared, and climate risks need to be more fully integrated into legislation and investment strategies.

Finally, an integrated approach to climate policy is crucial to successful adaptation. Adaptation strategies must be designed in such a way that they complement and do not conflict with other policy objectives in the environmental, social and economic fields. A holistic climate policy, embracing various objectives, is essential to ensure that adaptation is both effective and equitable.

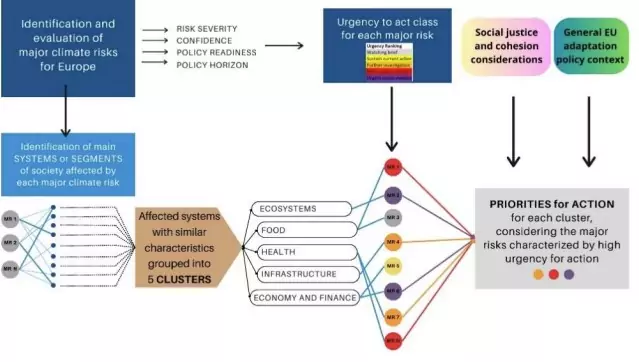

Approach to grouping the main climate risks and identifying priorities for action

Source : EEA

Conclusion: a call for collective action

As Europe confronts the growing threat of climate change, the involvement of insurers and reinsurers is becoming essential. These players in the financial sector have the potential to transform climate risk management, thanks to their unique expertise in risk assessment and innovative financing mechanisms. Their role extends far beyond simple compensation, encompassing risk prevention and facilitating adaptation to unavoidable changes.

The revelations by the European Environment Agency underline not only the urgency of the situation but also the need for a multi-dimensional response involving the financial and insurance sectors, policy and regulatory frameworks, and public-private partnerships.

The potentially catastrophic financial cost of climate change requires immediate attention to develop innovative financing mechanisms and insurance products that can offer adequate protection. Policy and regulatory frameworks must be strengthened and adapted to facilitate such innovation, while ensuring that the actions taken are both effective and fair.

Public-private partnerships offer a promising way of accelerating climate change adaptation and resilience, by combining resources, knowledge and skills from different sectors. These collaborations can play a key role in implementing sustainable solutions that benefit all levels of society.

In short, combating the acceleration of climate change requires collective, innovative and coordinated action from all players in society, including insurers and reinsurers. By leveraging their expertise in risk management and finance, insurers and reinsurers play a key role in reducing the vulnerability of societies to the impacts of climate change and in facilitating a transition towards greater resilience.

We share this conviction at Addactis and work daily to build solutions for the insurance industry to meet this major challenge. Do not hesitate to contact us for a presentation of our expertise.

This content was written by our experts:

Elie MERYGLOD

Senior Manager

Modeling & Risk Life

Addactis

Franck BATON

Climate Scientist

Pricing & Analytics P&C

Addactis

Mederick BESARABOV

Senior Manager

Pricing & Analytics P&C

Addactis

Mehdi AHMED

Lead Product Manager

Pricing & Analytics P&C

Addactis

Thibaut GILLIARD

Director

Modeling & Risk Health

Addactis

Discover other content related to climate risks:

EIOPA: Natural Disasters & Insurance Protection

Currently, only one quarter of the overall losses caused by extreme weather events climate-related are insured in Europe. There is therefore a deficit in protection in terms of NAT CAT insurance.